Compelling evidence of the economic significance of European city tourism

European Cities Marketing launched the ECM Benchmarking Report and the ECM Meetings Statistics Report with results from the year 2019 respectively on Bednights and Meetings in Europe. These reports with a detailed approach of the different markets show the healthy growth of the Industry before the pandemic that has changed the tourism industry forever. We may not come back to figures that high till a long time, the crisis leading the industry towards a more sustainable future.

An analysis of the situation before the pandemic as a target for recovery

The tourism industry has been severely affected by the COVID-19 pandemic. Yet, in spite of the challenging times, the importance of city tourism remains unquestionable. Moreover, in a context of strong competition amongst urban tourism destinations all around the globe, knowledge of the meetings industry in Europe remains paramount for many cities. This is especially true now as the world faces the numerous challenges brought by the COVID-19 pandemic, as it is essential to understand where we were before the crisis and to strive towards these targets in our recovery efforts.

ECM Benchmarking Report: a bednights’ average growth rate of 4.3% in 2019 in European Cities

The report provides crucial insights into the European city competitiveness. 119 European cities included in this report achieved an average growth rate of 4.4%, which is slightly higher than the previous year’s growth rate of 4.2%. The top five performing cities in terms of total bednights for 2019 were the usual suspects: London, Paris, Berlin, Rome, and Istanbul, with Istanbul also recording the highest growth rate (+14.1%).

The importance of city destinations for European tourism

Altogether, European city destinations represented 690 million tourist bednights last year. In addition, the average growth rate of bed capacity for the ECM Report cities gained momentum with an increase of 4.9% in 2019, while the highest bed occupancy rates were recorded in Dublin (85.7%), London (83.6%), and Rome (78.1%).

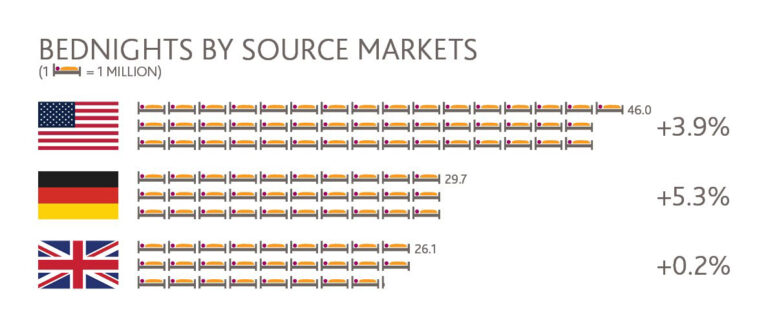

By looking at Europe’s main source markets (Russia, China, the United States, Japan, Germany, the United Kingdom, France, Spain, and Italy), it is evident that all showed an increase. Italy was the only market with an impressive double-digit increase: it had the highest growth rate in 2019 (+17.5%), followed by Germany (+5.3%) and Japan (+4.1%), whereas the lowest growth rate was recorded in the United Kingdom market (+0.2%). Moreover, the past year has shown a positive average annual growth rate of bednights in both the ECM Report cities (+4.9%) as well as in the EU 28 nations (+2.4%). Cities also grew faster than in other regions (+4.4% versus +1.5%). These figures alone demonstrate the importance of city destinations for European tourism.

ECM Meetings Statistics Report: a meetings’ average growth rate of 7.6% in 2019 in European Cities

This year’s edition is based upon data reported by 46 ECM member cities. Overall, there was a 7.6% increase in the total number of meetings reported between 2018 and 2019. After a slight decrease of 3% between 2017 and 2018, the total number of meeting participants rebounded in 2019, with an increase of 49.2% compared to 2018. Likewise, the total number of participant days reported between 2018 and 2019 saw a similar increase of 47.6%. These data indicate that, in general, 2019 saw a slight increase in the number of meetings held, but also a strong increase in the number of participants attending meetings.

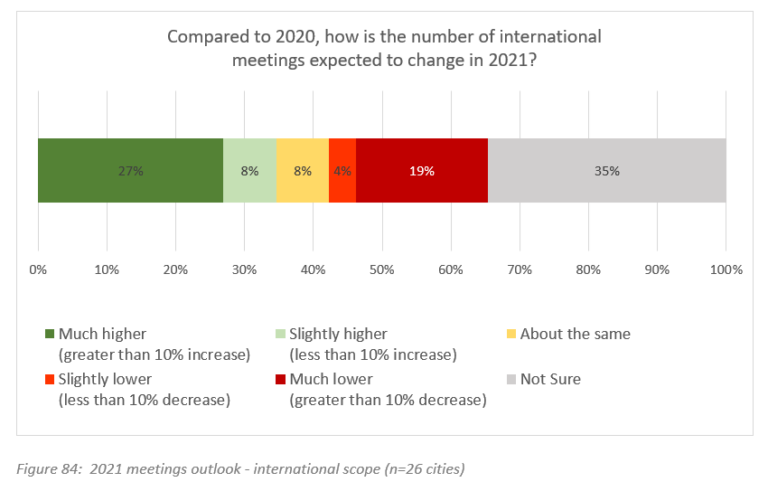

Future expectations for the meetings industry seriously impacted by the COVID-19 crisis

A total of 26 of the 46 cities providing data for the ECM Meetings Statistics Report also provided responses to questions regarding future expectations for the meetings industry in their city. These data serve as a barometer indicating early industry projections and measure the sentiment and outlook for the meetings industry at the time when 2019 meetings data were being reported in August of 2020. Due to the COVID-19 pandemic, there are very strong negative impacts on the meetings industry expected in 2020, with international meetings being hit especially hard. Because of this crisis, a great deal of volatility has been introduced to the meetings industry, and many of our experts are not sure what the medium-term impacts will be. This is clearly reflected in 2021 expectations, as no consensus emerges for what 2021 may bring for the meetings industry.