Like everywhere else in the world, the market for events in Germany plummeted in 2020: The number of face-to-face events and attendees fell by 70 percent and 86 percent respectively while the share of international attendees was at 2.4 percent last year in comparison to 10 percent in 2019.

According to Petra Hedorfer, Chairwoman of the Board of the German National Tourist Board (GNTB), Germany’s position in the European market with respect to business travel nevertheless remains stable: “Despite Covid-19-related declines, we were able to keep our number 1 destination for European business travellers in 2020: With 5 million business trips, Germany topped the ranking, far ahead of France and the UK in second and third place. The current business year offers cause for cautious optimism. According to IPK International, 22 percent of foreign travellers worldwide are planning business trips this year. Germany can benefit from this, especially as a MICE location in international competition. 81 percent of respondents planning business trips to Germany want to take MICE trips, 36 percent traditional business trips.”

Structural changes in the market

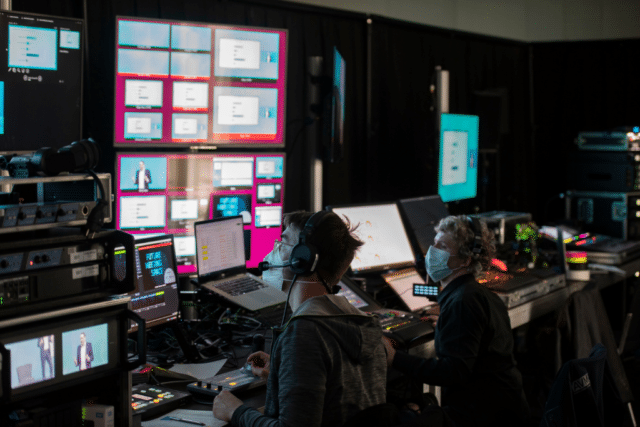

Both quantitatively and qualitatively, the German event market underwent structural change last year. Of all event types, business events, in particular, experienced a strong shift towards digital and hybrid formats. Overall, a considerable proportion of the face-to-face events planned for 2020 were rescheduled and held virtually due to the pandemic. Adding 2020’s hybrid, virtual, and face-to-face events, approx. 2.3 million events with around 234 million attendees took place in Germany in 2020, 0.8 million thereof face-to-face.

Shift in source markets

Due to the restricted air traffic and the cancellation of most international events, European source markets – in addition to domestic demand – initially gained in importance for Germany, with Austria, Switzerland and the Netherlands occupying places one to three in the ranking of the most important source markets. An international recovery is expected in phases, with first the domestic market coming back, followed by European and finally overseas demand. However, according to IPK, a high intention to travel for business can already be seen in 2021 for some overseas markets, above all in Japan, China, the USA and South Korea.

Adjusting capacities to “New Now“

Event venues significantly reduced their capacity due to safety and social distancing rules. Losses resulting from this and the many event cancellations lead to a 70 percent decline in turnover. For 2022, turnover losses of only 17.7 percent are expected. “Event centres, conference hotels and event venues are adjusting well even under the more difficult conditions. With the appropriate safety measures, as well as the necessary technology and infrastructure for running hybrid and virtual events, venues are ready for a safe re-launch of face-to-face events in the ‘New Now’,” says Ilona Jarabek, President of the EVVC.

Outlook on future developments

With increasing market recovery, due to the steady progress of the vaccination campaign and the implementation of a digital vaccination passport, a cautiously optimistic forecast can be made for Germany as a meeting and congress destination. The surveys of the Meeting & EventBarometer confirm this: According to the respondents, face-to-face events will come back strongly by 2022 with a growing share of hybrid events, whereas virtual events will decline again. The current and coming year can therefore be described as transitional years on the way to a new normality.

For more information, download the Meeting & EventBarometer 2020/2021 management summary here.