We hope the mentioned good practice case will encourage other governments and policymakers to do the same in their respective countries. Exhibitions and trade shows are the fastest of fast-tracks to economic recovery once the coronavirus crisis has passed and will deliver the best return on investment now. We sincerely thank UFI, EEIA, and EMECA for providing valuable information.

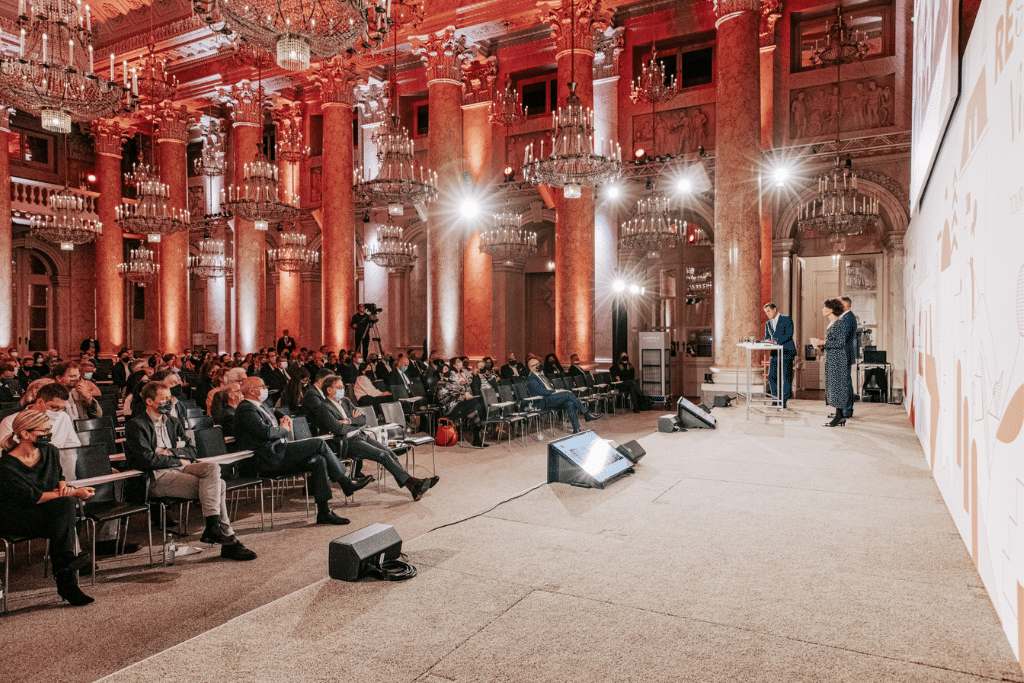

CASE STUDY: AUSTRIA

Austria was one of the most aiding countries when it came to the meetings and exhibitions industry. Their financial aid helped the industry persevere.

EMERGENCY HELP

Expenditure measures (direct grants):

On 9 April, under the Temporary Framework, an Austrian liquidity scheme to support the economy in the context of the coronavirus outbreak. The scheme is Austria-wide, targeted at all companies, and allows for the provision of aid in the form of: (i) Direct grants, repayable advances and guarantees with a maximum of €800 000; (ii) State guarantees for loans subject to safeguards for banks to channel State aid to the real economy; (iii) Subsidised public loans to companies, with favourable interest rates. The measure allows aid to be granted by COFAG (COVID-19 Finanzierungsagentur des Bundes GmbH), which is a special purpose vehicle to grant liquidity assistance measures. Aid is granted under the measure either directly or if it concerns guarantees on loans or subsidised public loans, through credit institutions and other financial institutions as financial intermediaries.

Measures related to public guarantees, loans, tax deferrals:

On 17 April Austrian guaranteed schemes to support Austrian small and medium-sized enterprises (SMEs) in the context of the coronavirus outbreak. The schemes will provide guarantees on working capital loans that will enable those SMEs to cover their short-term liabilities, despite the current loss of revenues caused by the pandemic. The schemes complement the €15 billion Austrian liquidity scheme that the Commission approved on 8 April 2020. The schemes will provide 100% guarantees for underlying loans up to an amount of €500,000 (except for the agricultural and the fisheries and aquaculture sectors, where the 100% guarantees are limited to underlying loans up to an amount of €100,000 and €120,000, respectively). For loans above those thresholds, the schemes will provide 90% guarantees for underlying loans up to €25 million. The schemes were approved under the State aid Temporary Framework adopted by the Commission on 19 March 2020, as amended on 3 April 2020.

RESTART HELP

Expenditure measures (direct grants):

On 6 July 2020, an €8 billion Austrian scheme to compensate companies for damages related to the coronavirus outbreak to be in line with EU State aid rules. Under the scheme, undertakings will be entitled to compensation for certain damages suffered as a result of the coronavirus outbreak. The compensation, in the form of direct grants, can cover a maximum of 75% of fixed costs incurred during a limited period of three months, with a maximum amount of €90 million per group.

On 18 September 2020, certain amendments to a previously approved Austrian liquidity assistance scheme to support Austrian enterprises affected by the coronavirus outbreak to be in line with the State aid Temporary Framework. The original scheme was approved on 8 April 2020 under case number SA.56840, and provides for temporarily limited amounts of aid in the form of (i) direct grants, (ii) guarantees on loans and repayable advances, and (iii) guarantees on loans and subsidised interest rates on loans. The aim of the original scheme was to enable enterprises affected by the coronavirus outbreak to cover their short-term liabilities, despite the current loss of revenues caused by the pandemic. Austria notified certain modifications to the original scheme, in particular: (i)micro or small enterprises can now benefit from the measure even if they were considered in difficulty on 31 December 2019, under certain conditions; and (ii)an increase of €4 billion in the total budget of the scheme, from €15 billion to €19 billion.

RECOVERY HELP

Expenditure measures (direct grants):

On 23 November, the second phase of an Austrian scheme to support the uncovered fixed costs of companies affected by the coronavirus outbreak. Under the state aid Temporary Framework, the aid, in the form of direct grants, aims to provide economic assistance to all businesses, self-employed individuals, associations and institutions, to keep them solvent and bridge liquidity shortages related to the coronavirus outbreak. The measure is a countrywide scheme and, together with the first phase of the scheme already approved by the Commission in May 2020 (SA.57291), has a total estimated budget of around €12 billion.

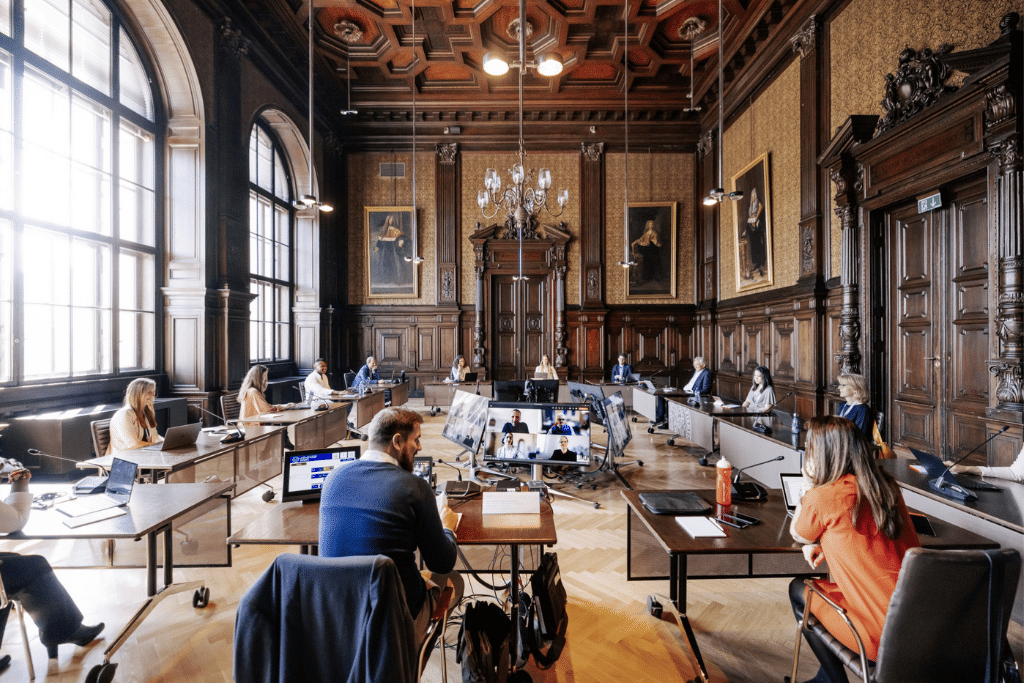

On 19 January 2021, under EU state aid rules, a €300 million Austrian scheme to support event organisers affected by the coronavirus outbreak. Under the state aid Temporary Framework, the scheme aims to provide economic assistance to all undertakings (including the self-employed, associations and institutions) whose activities will be cancelled or restricted until December 2022 due to the coronavirus outbreak. The measure

aims to encourage operators to restart their planning and organising activities.

To find out more about Austria’s aid scheme, click here.