A Survey On ROI And Mice Sales Activities by Kongres Magazine

A THIRD OF PARTICIPANTS IN THE SURVEY ARE COUNTING ON THEIR FEELINGS AND NOT ON MATHEMATICS AND ROI ANALYTICS

MICE sales departments have a number of sales opportunities and their key challenge is to maximize their added value.

The editorial board of the Kongres magazine conducted an extensive survey on measuring the ROI of individual sales activities. The target group of the survey was the selected providers, of which 72% were hotels and venues, 28% were agencies (Incentive, PCO, DMC agencies). The main aim of the research was to define how this is done in practice, because we believe that you cannot measure what you cannot manage. We also wanted to check whether the measurement of profitability is left to chance and where there is a lot of room for improvement.

Section 1: General questions about measuring the effectiveness of sales activities

All the participants answered the basic question “Do you have a way to measure and track ROI of your MICE sales activities?”

69% of respondents responded positively to the question, while a relatively large proportion of 31% does not use such tools and techniques.

This question was upgraded with the question “Do you have adequate information support for the measurement results of MICE sales?”

Among the participants, only 10% of all respondents have such a tool. The vast majority does not have a tool and relies on the following:

- Hotel PMS and reservation system

- Revenue tracking via Sales and catering

- Annual Statistical Report

- Own developed CRM system

Do you have the right platforms developed for the MICE industry?

- A CRM – 70%

- Your platforms – 40 %

- Social platforms – 30 %

- A marketing automation platform – 20%

- A content aggregator and distribution platform – 10 %

Among their own platforms, they highlighted special modules, which operate within hotel reservation systems.

Especially interesting are the answers to the question “Are you using any of the following indexes?” This question gives a more in-depth insight into the understanding of the sales channel. The results were as followed:

- Closed Opportunities (how much revenue your sales have generated) 80 %

- Win/Loss Rate (the percent of opportunities that you won) 50 %

- Leads by Source (where your customers are coming from) 40 %

- Open Opportunities 40 %

- Pipeline (at what stage is each open opportunity) 30 %

- Sales Cycle (the average duration or time it takes to win a deal) 30 %

- New Business vs Upsell (balance between new business with upsells) 30 %

- Your indexes 10 %

The results of the survey showed that one third of the respondents did not develop tools and techniques to measure the effectiveness of MICE sales activities. This surprising result is also complemented by the answer to the question whether the participants of the survey developed some sort of support system, among which the various CRM platforms and classical hotel information systems. They are probably excellent in performing their basic function, but are not adapted to measuring the effectiveness of sales and marketing activities. There is still plenty of room for improvement in this area.

Section 2: Importance of individual sales activities and marketing tools

The first question in this section was referring to the assessment of the importance of individual sales activities.

Please sort the following MICE sales activities according to their importance for you?

- Sales Calls 2.8

- Fam trips 2.8

- Content marketing 2.3

- Trade shows 1.6

- Exhibitions 1

This question was upgraded with the question: “Which are the most important key markets for individual companies?” Please sort the following potential European MICE markets according to their importance for you?

- United Kingdom 6.4

- Germany 5.6

- France 5.1

- Austria 3.8

- Belgium 3.8

- Switzerland 2.1

- Netherlands 1.8

- Sweden 1.7

- Spain 1.7

- Russia 1

The answers to the question “Which have been the most cost-effective channels for your MICE marketing?” were as follows:

- Direct 100 %

- Email 60 %

- Search 40 %

- Cold Calling 40 %

- Social 30 %

- Offline 10 %

- Paid Search 10 %

- Blog 0 %

Among the most important activities, the respondents positioned sales calls and fam trips. Also, the answers to the importance of individual sales tools indicate the conservative nature of the industry, which remains faithful to traditional tools, and where the modern solutions are very rare and do not refer to them as examples of good practice. We believe there are many possibilities for improvement in this area.

Section 3: The meaning of B2B events

Do you feel that attending B2B trade shows is an important part of MICE Sales?

90% of respondents answered positively to this question, and 10% do not consider B2B events as an important part of marketing.

Participants of the survey were asked which B2B events are the most effective in their opinion. What B2B events do you find most efficient based on actual statistics?

The following trade shows received the majority of votes (more than 10) (ranked by the number of votes received).

- IMEX Frankfurt

- IBTM World, Barcelona

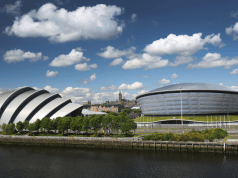

- CONVENTA, Ljubljana

- M&I Forums

- Connections

- IMEX America

Among the trade shows that received less than 10 votes, also the following fair trades were mentioned: IHG Shows, WTM London, BIT Milano, TTG Rimini, SITE forum, MPI EMEC and others.

Section 4: Database management issue

The participants were asked whether they have an active database that is regulated in the CRM system. 91% responded positively, and 9% did not have a database for MICE.

They also answered the question of the size of their database and the structure of the answers is as follows:

- 0 – 1000 contacts 63 %

- 1000 – 5000 contacts 16 %

- 5000 – 15,000 contacts 12 %

- 15,000 – 30,000 contacts 7 %

- More than 30,000 contacts 2 %

Another survey question was: Do you measure the average costs of gaining new business contacts? In this area, too, we were surprised by the answer that 91% of respondents do not measure the costs of gaining new contacts.

Section 5: Instead of the conclusion

The poll was concluded with a provocative question “How do you know your MICE sales were successful?”

- ROI Analytics 64 %

- Math 62 %

- Magic 23 %

- Other 11 %

The answer to this question is supporting the initial finding that a third of respondents rely on their feeling when measuring the effectiveness of the marketing. There is definitely room for improvement in this area.

We have also collected some of the most interesting answers to the question “What challenges did you face last month in closing Hot MICE Leads?”

- Flight connections (frequency and price)

- Lack of luxury infrastructure

- Lack of space in high season

- More qualified people in sales

- Better CRM

- Coordination of the destination

- Finding personalized solutions for clients

- In the end it is always about the price or better very good value for money

- Activation of local ambassadors

- Online booking platforms

- A strong local CVB which can support bids not only with good words and a few gadgets

- Politicians who understand the importance of the MICE industry

We were impressed by the individual response of one of the respondents, who nicely summed up the basic essence of the current survey:

1 To create the message; an offer, an opportunity, a must do, …

2 To define a criteria: markets, clients, economical sector, …

3 To adapt the offer to the client’s preferences; contents, look, message, …

4 To communicate it; via email, social media, a combination of both, …

5 To easily follow up and work on the hot leads

6 To confirm the business

Despite large investments in MICE marketing, a lot of companies are still calculating the return on investment, as it is common for all other investments. The situation is therefore too sordid and serious approaches are more an exception than the rule.

The performance of complex marketing in the MICE field depends on a large number of variables. However, we recommend that you begin your investment in marketing as soon as possible, and measure ROI (Return On Investment) on a regular basis. There are many different methods and techniques, all of which begin with a clear determination of sales targets. Only in this way will the current situation change, where 23% of respondents rely on magic in performance measurement.