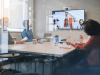

Business travel recovery in 2021 proceeded at a slower, more cautionary pace than expected, particularly across Western Europe where business travel underperformed compared to other markets across the world. This is according to European-specific data from the latest business travel index–the BTI™ Outlook, from the Global Business Travel Association (GBTA), the world’s largest business travel association.

According to the BTI global forecast, the recovery in global business travel is expected to be relatively strong over the next couple of years, with a full recovery in global business travel spend expected in 2024, ending the year on pace with the 2019 pre-pandemic spend of $1.4 trillion (USD), and a year sooner than previously forecast. However, whilst Western Europe will recover within this timeline, Emerging Europe (Eastern Europe) lags behind, with near recovery forecasted for 2025.

Covid-19 Variants Continue to Challenge Recovery

According to a recent GBTA poll, respondents based in Europe (90%) are more likely to say they are concerned or very concerned about the revenue impact on companies in the business travel sector due to Omicron compared to those based in North America (79%). Respondents based in Europe (32%) are also more likely to report their company has introduced new restrictions on non-essential business travel or new travel requirements as a whole, due to the Omicron variant, compared to those based in North America (12%).

Forecasting a Strong Business Travel Recovery

Over the next few years, however, European business travel is expected to recover strongly. This was evident during a brief period from August- September when European spending began to outpace the rest of the world.

Europe represents 10 of the top 20 business travel markets in the world. Five of the European markets (UK, Germany, Italy, Belgium, and Sweden) performed worse during the pandemic but are expected to recover quickly, three (Spain, France and Austria) are more resilient and have performed better during the pandemic and recovery to date. Two (Russia and the Netherlands) are flagging behind and whilst performing better through the pandemic, are showing signs of slower recovery.

Business traveller sentiment is strong in the region, with 54% of travellers expecting to be back to pre-pandemic levels of business travel by the end of 2022. Whilst Western Europe is set to reach pre-pandemic spending levels in 2024, the BTI™ Outlook forecast does not expect Emerging Europe’s business travel spending to recover to the pre-pandemic peak until after 2025.

“Vaccination rates in Western Europe, are outstripping those in many other parts of the world, however, the uncertainty around the variants has tempered recovery as covid cases have risen sharply through the last quarter of the year. New lockdowns and changing travel bans, border requirements and quarantines, are challenging the pace of recovery and adding risk to the recovery forecasts. It is vital that the region has a common, traveller-based approach, to facilitate the ability to do business and to travel as we enter into 2022,” said Catherine Logan, Regional Vice President – EMEA GBTA.

Read GBTA’s full survey on the effects of omicron on the meetings industry below.

Loading...

Loading...